The pitfalls of partial AP automation

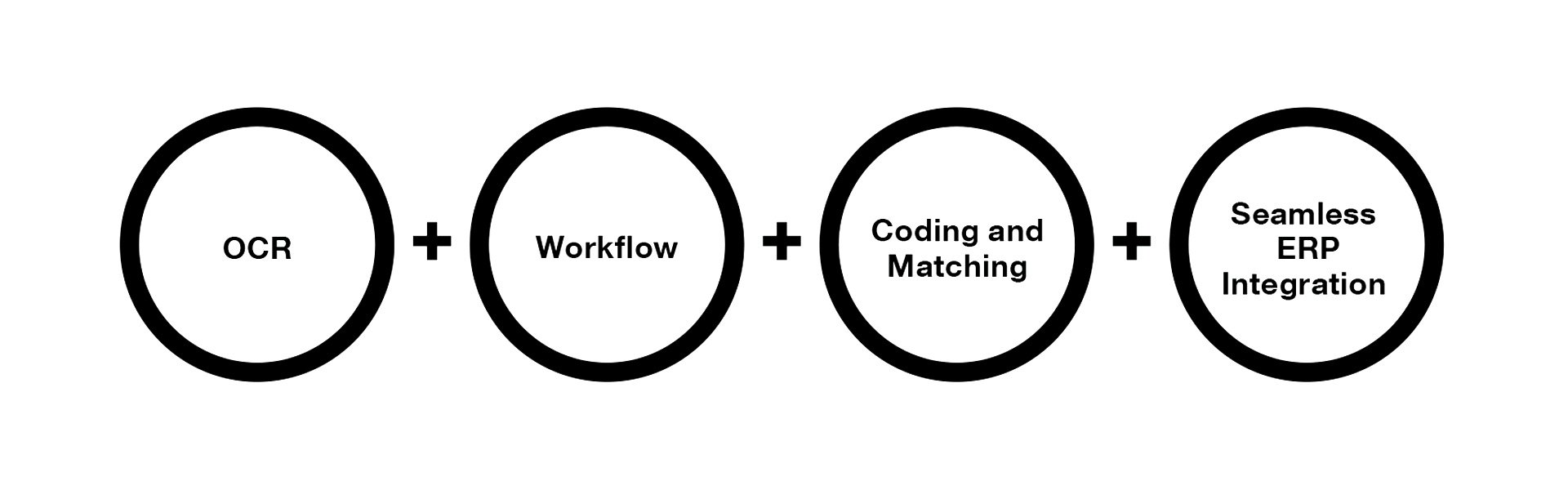

Some companies are automating only parts of the process – such as using Optical Character Recognition (OCR) to recognize characters in paper invoices, or workflow to move the invoice through the handling and review/approval process. But the reality is that true automation must include all of that.

So, imagine receiving an electronic invoice that is automatically coded and entered into your invoice automation system, and gets routed through an electronic workflow that generates reminders for reviewers and enforces

compliance of your policies – such as who can approve invoices and at what financial thresholds. Imagine PO-matched invoices being passed straight through – without human intervention – to the ERP system for processing. Then, AP staff would just handle exceptions and have time to focus on other, more strategic activities.